A recent survey of PVC readers really underlined just how many of you are freelancers, so I thought it would be a great time to kick off a series of articles that tackle some of the business aspects of freelance creative work. We’re going to start today with a very dirty word for many of us; accounting.

We all have to deal with it on some level and at times, running a solo freelance business can definitely feel like a juggling act. Accounting was always the first ball that I’d drop and in reality it’s probably the one that can have the greatest effect on a business.

A few years ago I started to use a cloud accounting service called FreshBooks. I’m not going to call this a review, because the fact that I’m still using it after several years means my conclusion is pretty obvious. Also, FreshBooks has close to 5 million users now so they must be doing something right….

What I’m going to do is run through some of the main features and underline why they are so useful to freelancers of all types and why you should be using some form of simple invoicing and accounting service, whether it be FreshBooks, or one of the other options that I’ll outline towards the end of the post.

Invoicing

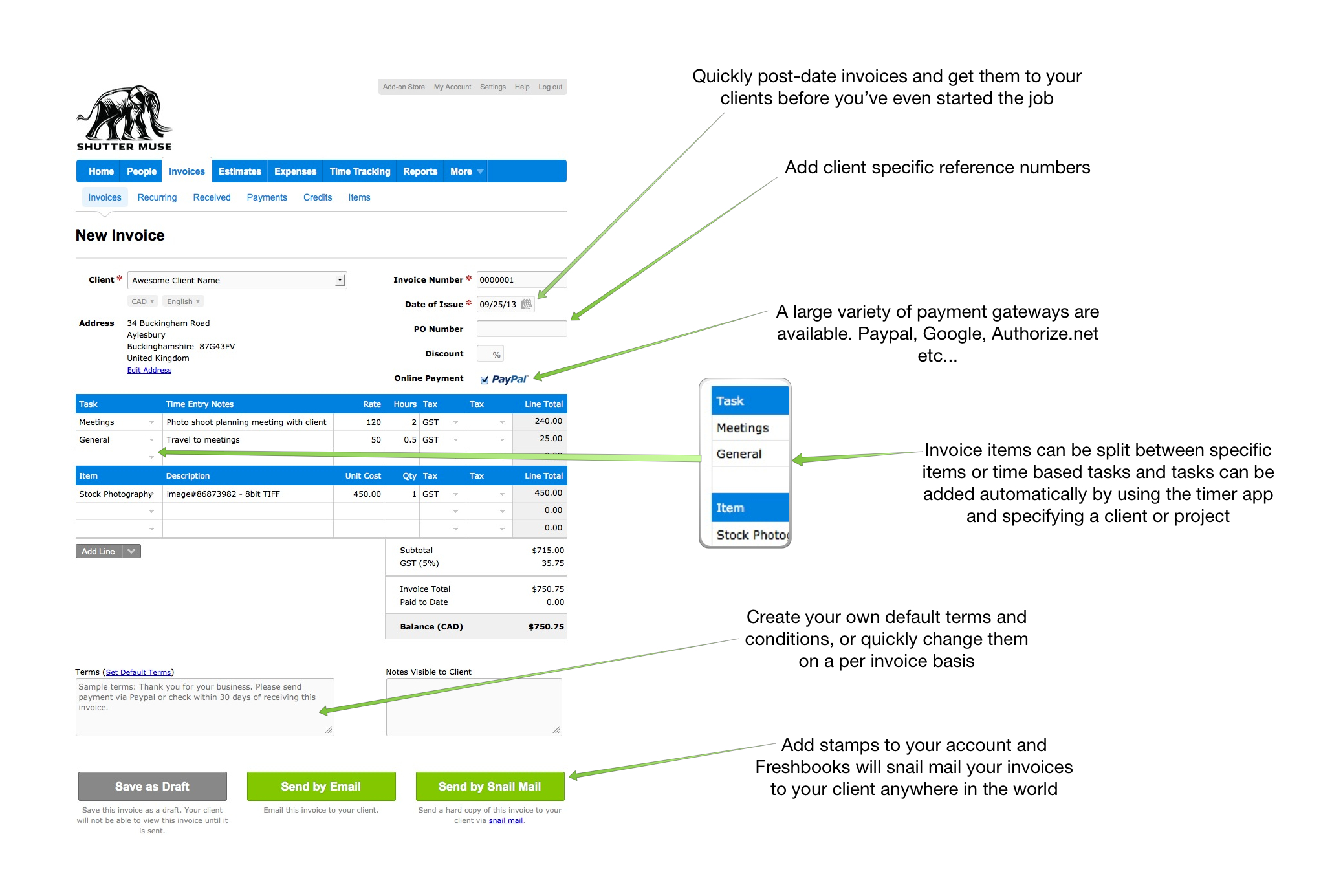

I want to be behind a camera. It’s where I belong. You know where I don’t want to be? In front of a computer creating mediocre looking invoices ten at a time that I should have done months ago. I might not be speaking to all of you here but I can guarantee I’ve already got more than a few of you nodding your heads. I forget exactly where I first learnt about FreshBooks, but it was a desire to tame my invoicing process that lead me to sign up. Batching your invoices every month can be an easy trap to fall into but it’s not doing anyone any good. You need to keep the money flowing in and if your client is a small business, getting invoices when they don’t expect it can have a frustrating effect on their budgets. Too many freelancers beat around the bush when it comes to asking for money. It’s time to get paid!

CLICK THE IMAGE TO VIEW LARGER

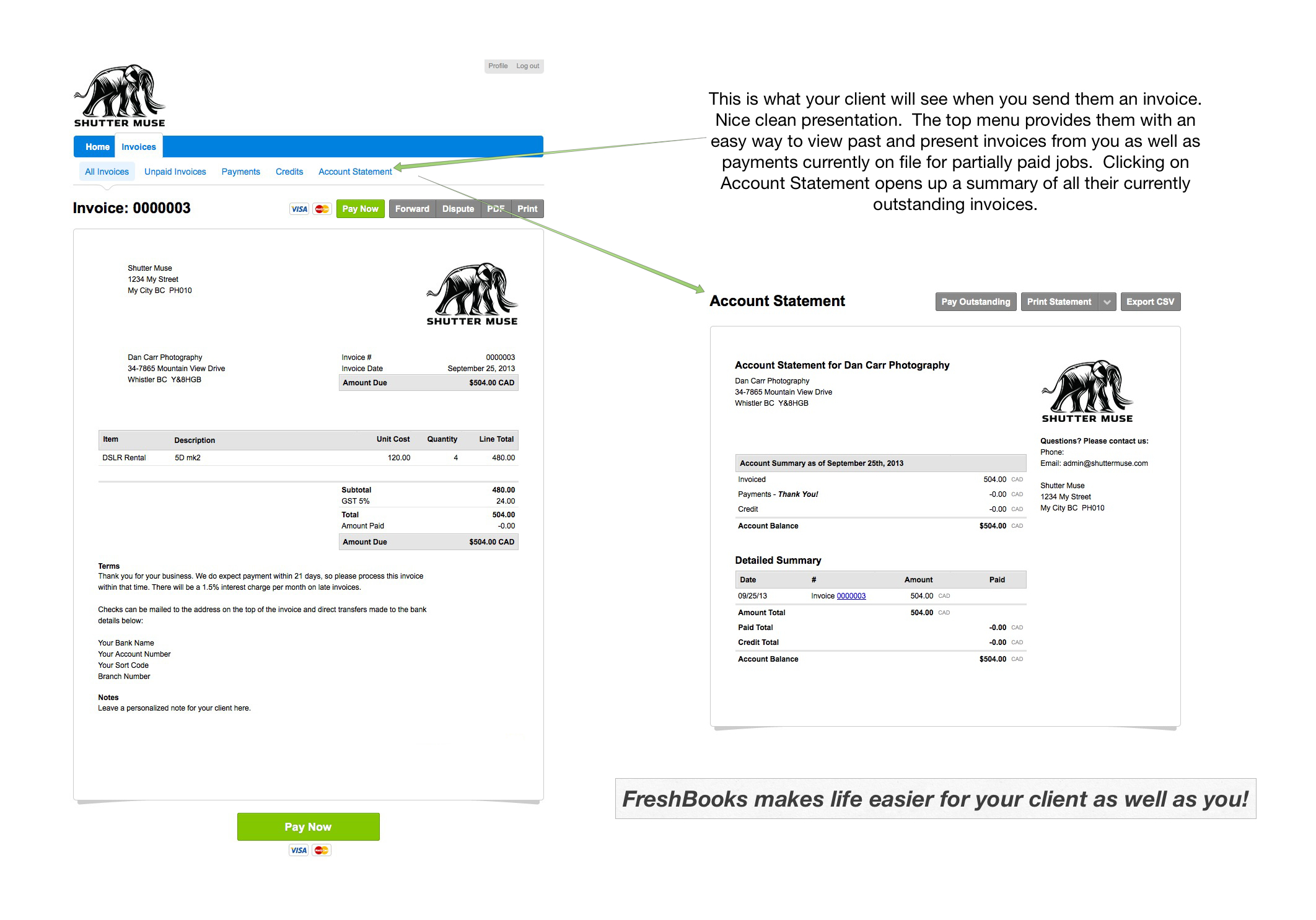

The first great feature of the FreshBooks process is that you can include a pay now button right there on the digital invoice that gets e-mailed to the client. There’s a number of services you can connect, but I’ve chosen to add PayPal and Stripe for taking all manner of credit cards. In 2009, FreshBooks did a survey that revealed that on average, their users were getting paid 14 days faster than other business owners. Much of this is down to the option to pay using credit cards. Payments often come late, but a lot of the time it’s not that the business doesn’t want to pay you, it’s simply that they are just like us, they hate accounting as much as we do. Make it easy for them, give that credit card pay now button and a lot of people will choose to use it. As a sole proprietor, cash flow is everything. Keep that money flowing as fast as you can by getting invoices out as quickly as possible. Incidentally, if you have a client that prefers to receive their invoice in the mail, FreshBooks will handle that for you as well so you don’t need to lift a finger.

When a client doesn’t pay on time you can automate the whole process of following up with them at specific time intervals. You can edit the content of those follow-up emails and choose whether any late fees should be automatically applied to a new invoice that’s sent to that client. these settings can be global, or they can be tailored to specific clients. For example, I turn off some of the late fees on the first reminder for a lot of my repeat clients if they’ve earnt that.

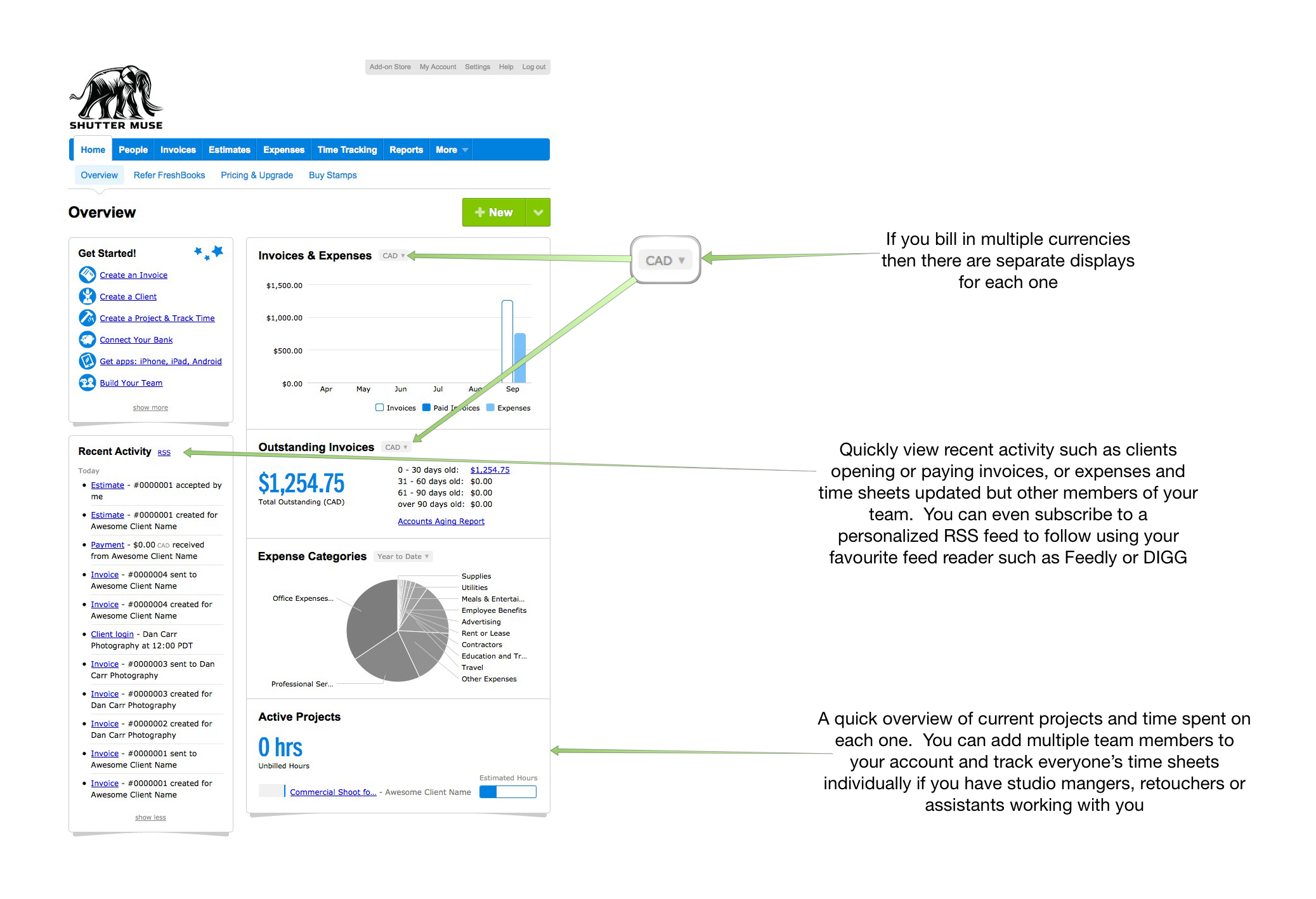

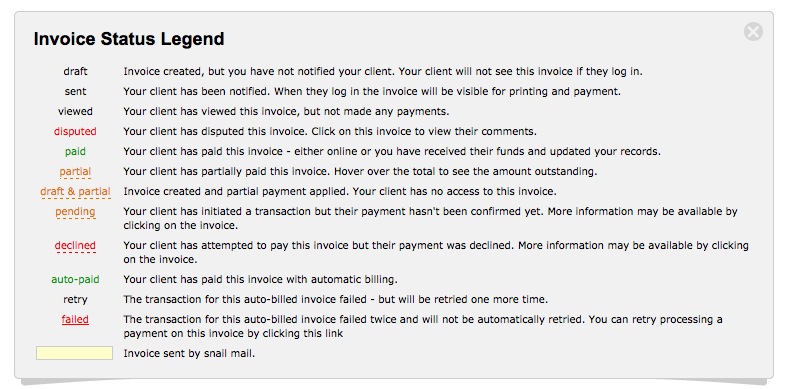

Not only is the process quick and painless, but it also creates great looking invoices which reflects well on your business and professionalism. When an invoice is sent via e-mail, your client is given a link to click and from there they can print it, save it as a PDF or pay it with a credit card. An added featured that I’ve found very useful is the invoice status feed. This will actually tell you when an invoice is opened so when you get that client that says “I’m sorry Dan, I never got that invoice”, you can politely remind them of the exact hour, minute and second that they opened it and ignored it. Sometimes someone genuinely doesn’t get the invoice though for one reason or another and this system has been a great help here as well. If I send an new invoice and see that after 7 days it’s still not been opened at all, I can follow up with them and ask them to double-check their in-box for it. Un-paid invoices are clearly marked in the feed as well so if your follow-up notices go unanswered, you’re given a constant reminder of who owes what. You can even get reports on how long each of your clients take to pay you on average or keep track of your invoicing activity via a dedicated RSS feed for your business.

Of course FreshBooks will also tally up all of your income in nicely formatted reports as well so at the end of the year you don’t need to sort through folders of invoices to figure out your monthly income.

On the next page: Creating estimates and managing your expenses the easy way

Estimates

When someone asks for an estimate you should always assume that you aren’t the only one that they asked. Perhaps if it’s a repeat client that might not be the case, but nonetheless you should always treat it so. Perhaps the client hasn’t made you aware of the tight timeline they are on and just maybe they will take the first estimate within their budget rather than waiting for all of them to come in.

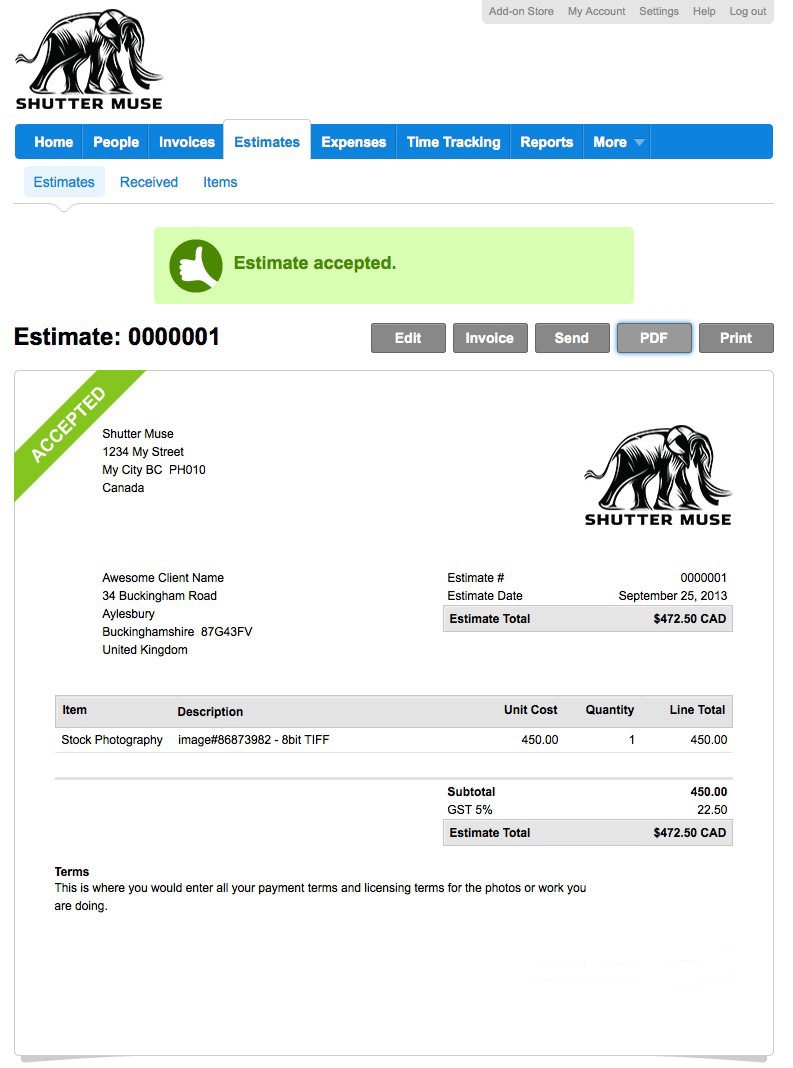

With FreshBooks, creating an estimate is an almost identical process to creating an invoice. You can manually add line items for a project, or pick things from your pre-determined list of company products. As long as the job isn’t too complicated, I can usually have an estimate on it’s way in a few minutes if I’m provided with enough detail. When a client receives the estimate they are given a couple of big buttons to choose from. If they click “Accept” then we know we’re all on the same page and with one more click I can convert the estimate to an invoice ready and waiting to fire back to them on the job’s completion. If they want to revise something, they can hit that button instead and return some notes to make adjustments. Again, not only is the process quick, but it also looks great and gives an excellent impression of your business and attention to detail. Importantly, this process is very clear. By asking someone to hit the button to “Accept” the estimate you can hopefully avoid problems in the future where someone says that the project is more expensive than they had anticipated.

Expense Tracking

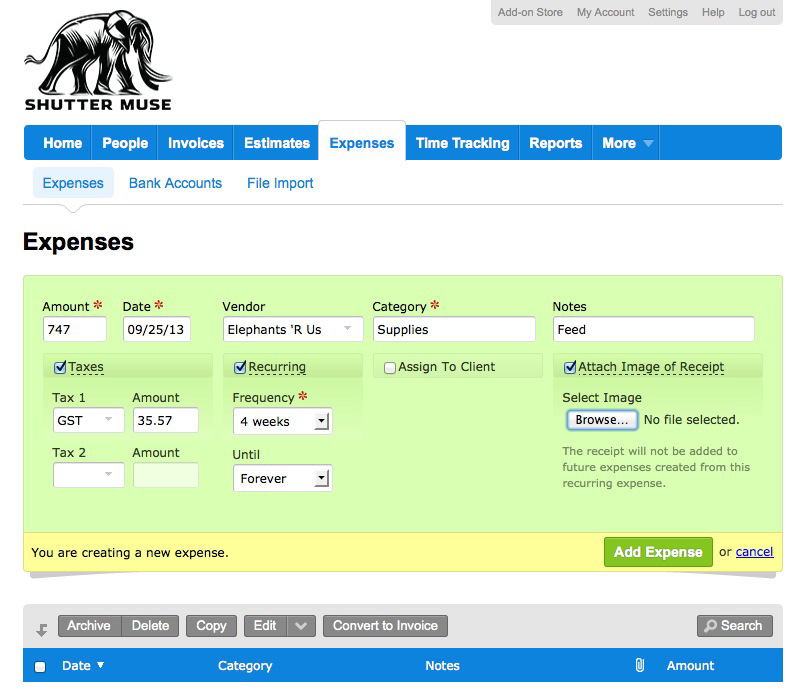

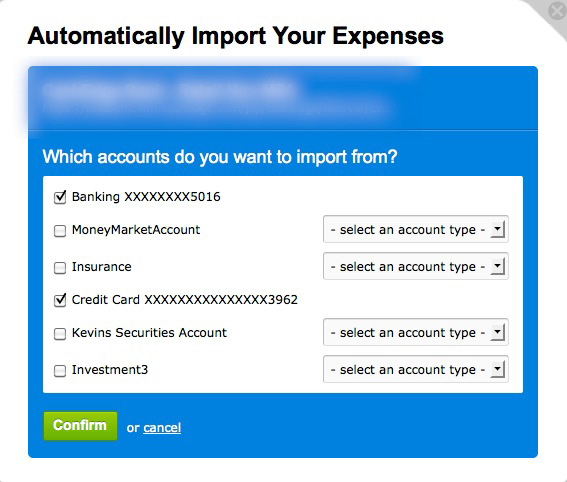

FreshBooks can help you tame that shoebox full of receipts that you keep in the corner of your office! Or at the very least it can stop you having to rely on them to record your business expenses. The easiest way for you to manage expenses in FreshBooks is to connect your bank account and credit card to your FreshBooks account and let them do all the heavy lifting. Every time theres is a debit from your account or card, it will pop up in FreshBooks and ask you to assign a group to it. Maybe office expenses, hotel or advertising. After a while, when certain businesses show up again and again, it’ll start to automatically categorize your expenses for you. When you log into your account you’ll be greeted with a note that tells you how many uncategorized ones there are, and it usually just takes a minute to run down the list and get things up to date. You can set recurring expenses, like website hosting for example, and you can apply expenses to specific clients and jobs. When it comes time to invoice those clients, you can choose to include all the expenses related to that project on the invoice at the click of a button.

I’ll admit that I used to be pretty bad at keeping track of my expenses. I’d randomly pull cards out of my wallet when it came time to pay for things, or I’d pay cash if it had it right there. This SUCKED when it came time to account for everything at tax time! Since connecting my accounts to FreshBooks I now diligently run all my business expenses though my business credit card so every single thing is recorded into the app automatically. Yes I do still have a shoebox in the corner of my office, but now the receipts in there are only needed as a backup and not relied upon to remember expenses incurred from certain projects.

On the next page: Mobile Apps & Time Management with FreshBooks

Mobile Management

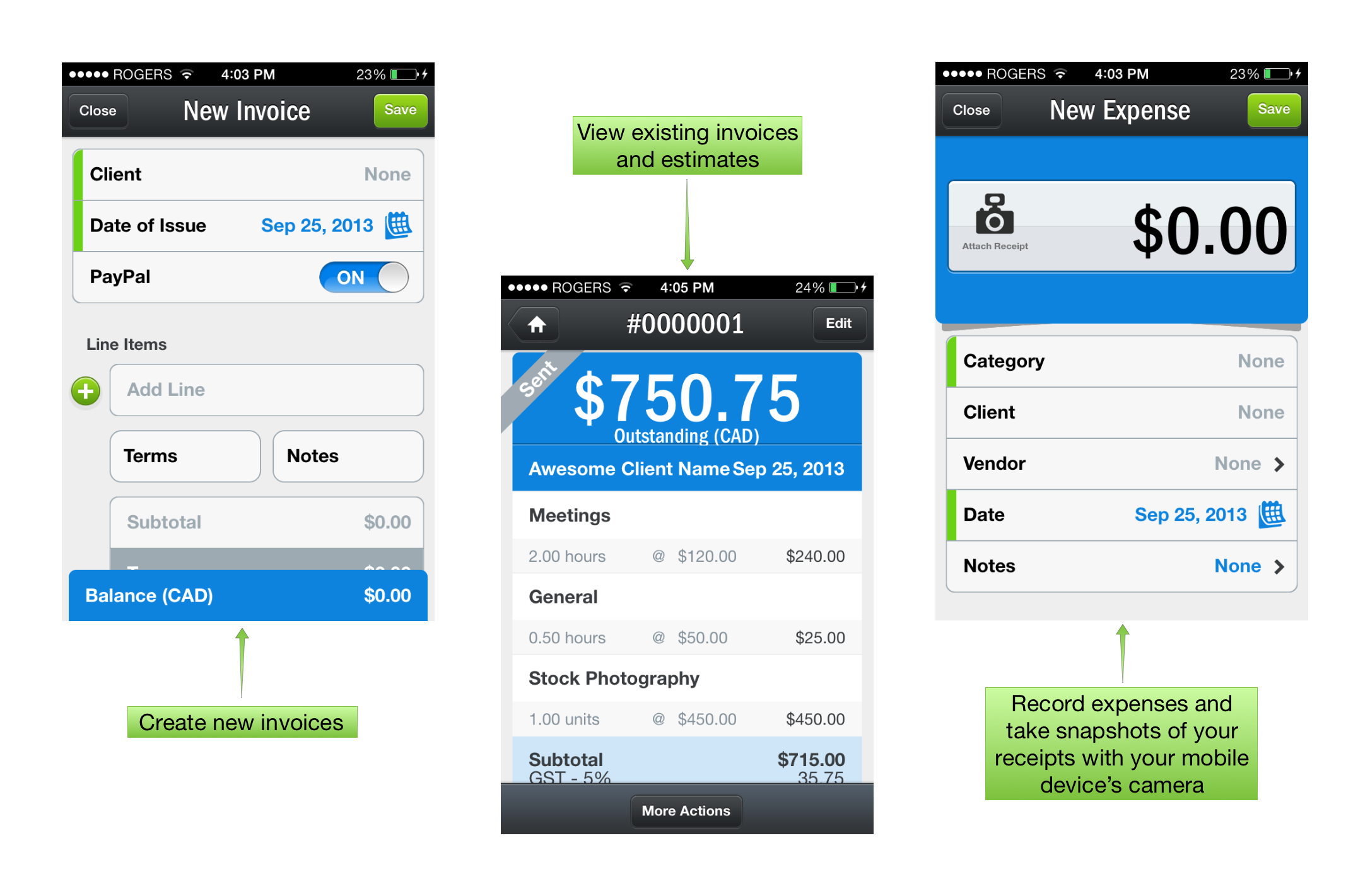

The beauty of a cloud based service is that you can access your data from wherever you are. You can use the regular browser interface but FreshBooks also have mobile apps that can take care of much of the important functions in a very mobile friendly fashion.

You can add expenses on the fly as you incur them, and even use your smartphone’s camera to snap a photo of the receipt while you’re at it. If you’ve got your credit cards and bank accounts connected for automated expense reporting already, you might think this is a bit redundant, but there will always be occasional cash expenses like parking tickets and cab rides. These are normally the things that slip between the cracks but recording things with the mobile app quickly becomes second nature and you can quickly assign expenses to specific projects. I made particularly heavy use of the expense recording features while traveling outside of N.America where it’s far less guaranteed that you’ll be able to pay with things on a credit or debit card.

Since the invoice and estimate creation system is so simple as well, if you’ve already got a client and services registered in your account, you can have a beautifully formatted invoice created and sent to them as PDF in under 30 seconds from your phone. If someone catches you out of the office and asking for a quotation, again, you can have this on it’s way in minutes not hours.

It also serves as a handy reference tool because you’re holding your accounting history in your hand so when it comes to creating a quotation for a new job on the road, you can easily refer back to past projects and final invoices that were sent to previous clients for similar work.

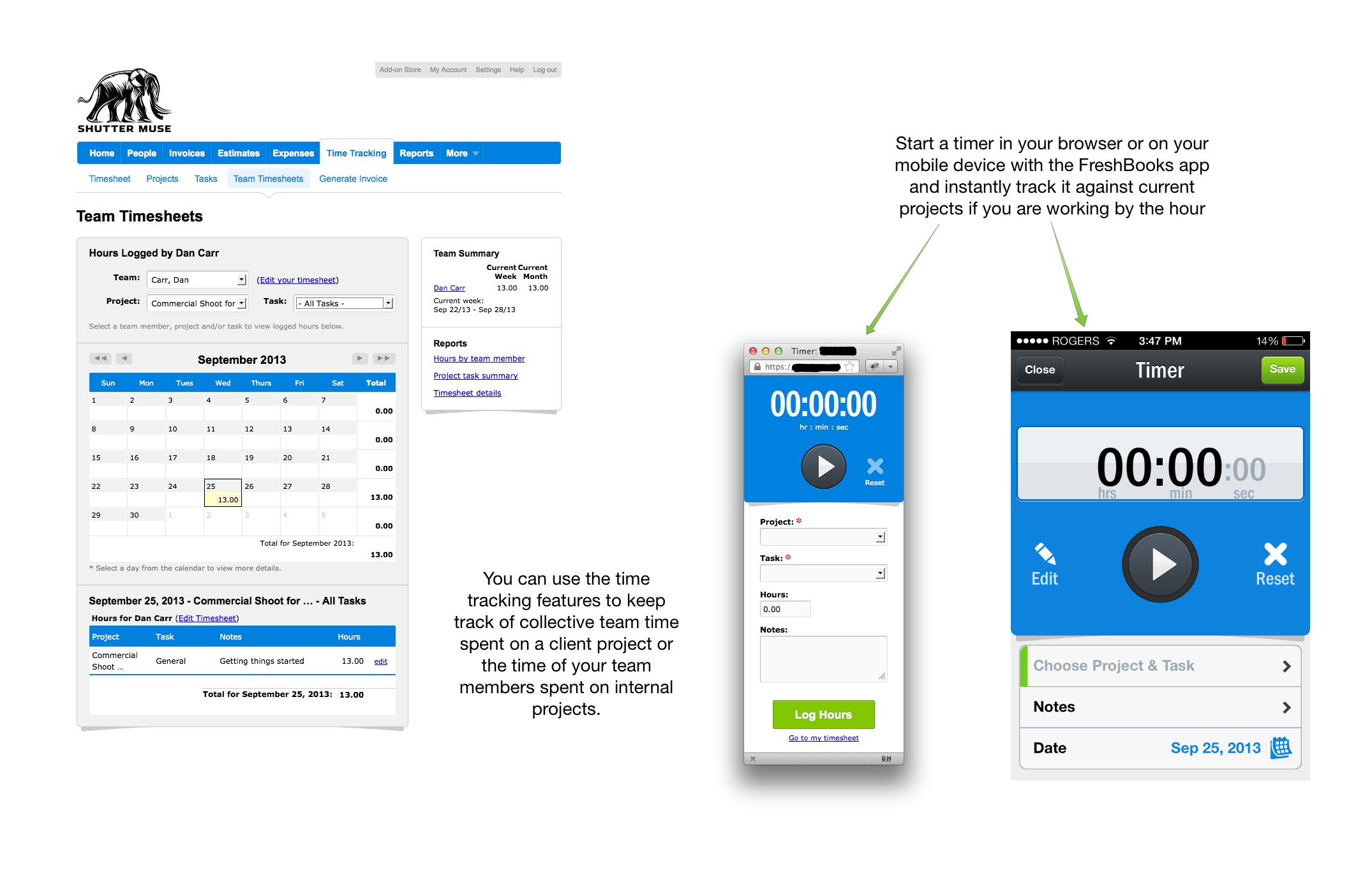

Time Tracking

Whether this is a useful feature to you or not will depend a lot on exactly what type of freelance work you’re doing and whether you price yourself by the project or by the hour. For video editors you can activate the stopwatch from the FreshBooks web interface and easily track your editing time on the computer. You can choose which project to assign the time to from a list of active projects in a drop-down menu, and add additional notes as to what you specifically worked on. When it comes time to send out your next invoice, all of the time tracked data with your notations will be added to the invoice for that client in just a couple of clicks. You can even set this up to occur automatically at a specified time interval if you are working as a contractor on a long term project that gets invoiced weekly or monthly. If you work as a team, the team timesheets feature allows multiple contributors to track their times individually and have it all sync up to one account.

If you are working on location then the mobile app is going to be of more use. Simply pull out your phone and start the timer in the FreshBooks app. Once again, the time will be added to the specified project.

Whilst a lot of my work is quoted on a per project basis, I’ve still found the timers useful for my own reference. When I get to the end of a project I tally up time spent on different aspects of the job and confirm, hopefully, that my estimates were in the right ballpark. If they were out, then I’m constantly building a reference of timing to refine my estimates for the future.

On the next page: FreshBooks alternatives & conclusion

Other Options

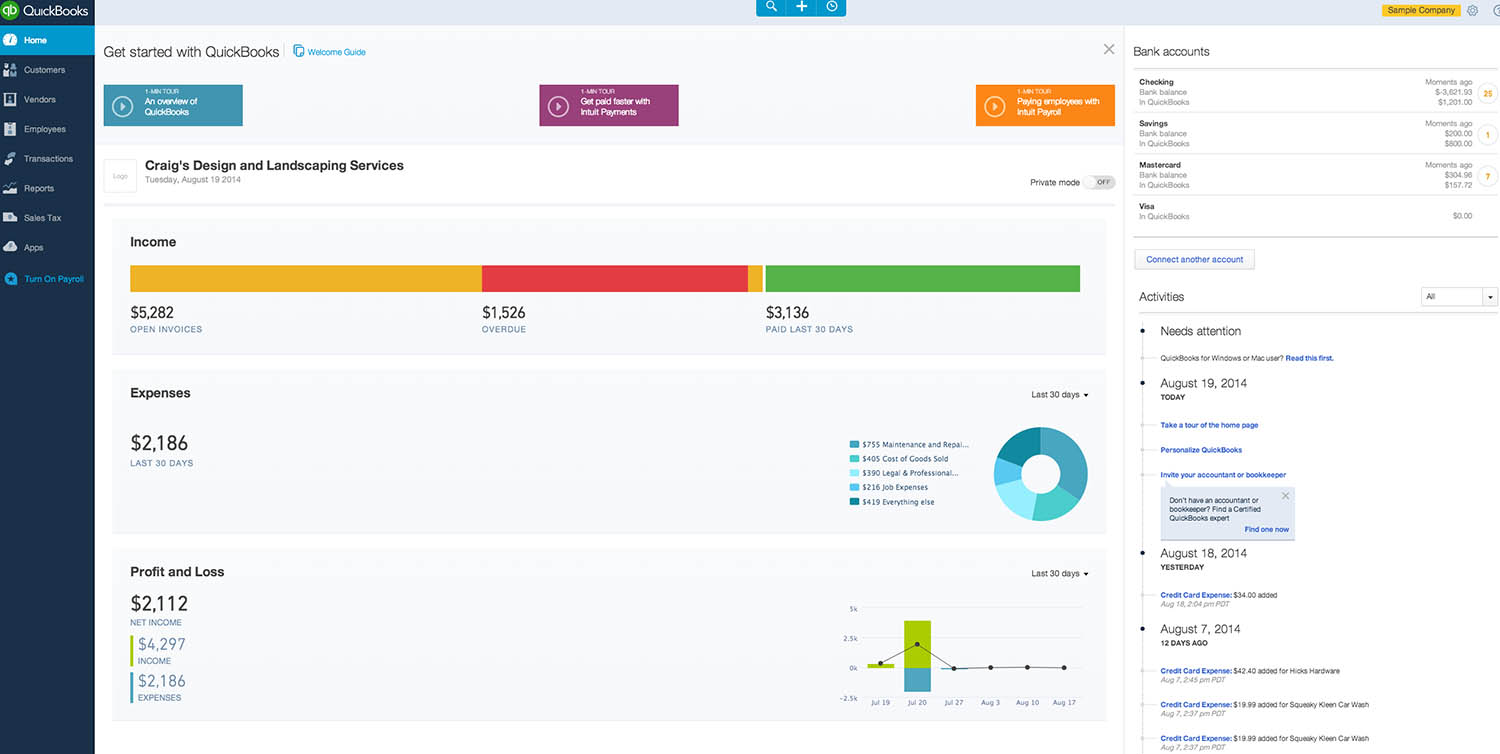

QuickBooks Online

Whilst I’ve been using FreshBooks for several years, I’ve also been looking at other options recently with posts like this in mind. QuickBooks Online was the next one that I’ve taken a lot of time to investigate. FreshBooks is really designed with freelancers in mind and as we’ve seen, it does a great job at time tracking, invoicing and managing expenses. In the end though, you’ll still need to hand off information to an accountant or bookkeeper at the end of the year. QuickBooks on the other hand is powerhouse in the accounting software world. There’s a good chance that your bookkeeper already uses it for their clients. QuickBooks Online (QBO from here on out) is a cloud based service just like FreshBooks. They have mobile apps and a secure web interface meaning that you always have access to all your data wherever you go. In terms of complicated accounting processes, QBO takes things to another level compared to FreshBooks, but this approach might not be for everyone. It does a lot of things that I just don’t feel comfortable doing myself and in reality I think that most folks are better off with the simplicity of FreshBooks. With QBO I would still need a bookkeeper to log in and actually work with all the information that I’ve input. You can create invoices in QBO, and automatically pull in expenses from your bank accounts, just like FreshBooks. What you can’t do though is automate things like follow up emails for late invoices. I found the whole process of creating invoices much better in FreshBooks, and I also preferred the client side experience of receiving them as well. If you live in the US you can enable “pay by credit card” options for QBO e-Invoices, just as you can in FreshBooks. If you live in Canada though, as I do, this option isn’t available. In fact there are MANY discrepancies between the available features in various countries with QBO and I found that utterly infuriating.

Whilst I’ve been using FreshBooks for several years, I’ve also been looking at other options recently with posts like this in mind. QuickBooks Online was the next one that I’ve taken a lot of time to investigate. FreshBooks is really designed with freelancers in mind and as we’ve seen, it does a great job at time tracking, invoicing and managing expenses. In the end though, you’ll still need to hand off information to an accountant or bookkeeper at the end of the year. QuickBooks on the other hand is powerhouse in the accounting software world. There’s a good chance that your bookkeeper already uses it for their clients. QuickBooks Online (QBO from here on out) is a cloud based service just like FreshBooks. They have mobile apps and a secure web interface meaning that you always have access to all your data wherever you go. In terms of complicated accounting processes, QBO takes things to another level compared to FreshBooks, but this approach might not be for everyone. It does a lot of things that I just don’t feel comfortable doing myself and in reality I think that most folks are better off with the simplicity of FreshBooks. With QBO I would still need a bookkeeper to log in and actually work with all the information that I’ve input. You can create invoices in QBO, and automatically pull in expenses from your bank accounts, just like FreshBooks. What you can’t do though is automate things like follow up emails for late invoices. I found the whole process of creating invoices much better in FreshBooks, and I also preferred the client side experience of receiving them as well. If you live in the US you can enable “pay by credit card” options for QBO e-Invoices, just as you can in FreshBooks. If you live in Canada though, as I do, this option isn’t available. In fact there are MANY discrepancies between the available features in various countries with QBO and I found that utterly infuriating.

Long story short, if you’re looking to just keep your invoicing on point, and track time spent on certain client projects then FreshBooks is definitely the way to go. If you really like numbers and want a one stops hop for your business accounting then QBO will do it all, but there is a much steeper learning curve. Interestingly though, it’s actually cheaper than FresBooks.

Xero

Xero’s featureset seems comparable to FreshBooks and the pricing plans are in the same ballpark as well. There’s a few differences worth noting though. Firstly, if you want to invoice in multiple currencies then you can only do this with the $40/month plan. With the world becoming ever smaller these days, I can’t help thinking that many of you, like me, are doing business with clients all over the world. Keep this in mind. The other differentiator that jumped out at me is that all Xero accounts allow unlimited users, whereas FreshBooks need you to step up to their third pricing tier to even get one additional person added to the account. Since I’m a one man business, it’s never been an issue for me, but again it’s worth keeping it in mind when making your evaluations.

Xero’s featureset seems comparable to FreshBooks and the pricing plans are in the same ballpark as well. There’s a few differences worth noting though. Firstly, if you want to invoice in multiple currencies then you can only do this with the $40/month plan. With the world becoming ever smaller these days, I can’t help thinking that many of you, like me, are doing business with clients all over the world. Keep this in mind. The other differentiator that jumped out at me is that all Xero accounts allow unlimited users, whereas FreshBooks need you to step up to their third pricing tier to even get one additional person added to the account. Since I’m a one man business, it’s never been an issue for me, but again it’s worth keeping it in mind when making your evaluations.

Kashoo

With $49/year plans, kashoo is well worth a look. Automated expense importing is available from your bank accounts and credit cards and there’s the usual selection of mobile apps to help you manage money on the go. The pricier $199/year plan adds multi-user access and payroll integration but even this plan comes in cheaper than FreshBooks’ lowest tier plan. The biggest downside to Kashoo is that it doesn’t, for some unknown reason, have a quotation or estimate feature. I’ve always loved the ability to turn an estimate into an invoice at the click of a button in FreshBooks. They also don’t have payment gateway support for your clients to pay your invoices with a credit card.

Nutache

This one is a bit of a head scratcher. It’s a totally free invoicing and time tracking service that promises to be 100% free forever. It appears to be lacking automated expense tracking, and I haven’t tried the service myself, but since it’s free and FreshBooks isn’t cheap it might be a good first stepping stone for some people. Call me skeptical, but I can’t imagine ever getting amazing support from a service you don’t pay for though.

This one is a bit of a head scratcher. It’s a totally free invoicing and time tracking service that promises to be 100% free forever. It appears to be lacking automated expense tracking, and I haven’t tried the service myself, but since it’s free and FreshBooks isn’t cheap it might be a good first stepping stone for some people. Call me skeptical, but I can’t imagine ever getting amazing support from a service you don’t pay for though.

Conclusion

Whilst the thought of paying for another yet subscription service can be off-putting, there’s no doubt that FreshBooks pays for itself every month for my business. Sometime it’s in recovered revenue from otherwise forgotten about expenses and other time entire invoices that might be forgotten in a busy month. I’m a big fan of simplifying every aspect of the business of freelance creative work because it gets us back behind the camera which is where our value is truly greatest (or back in the editing suite!). For most freelancers, the $19.95/month plan will be plenty to work with and when you think how much most of us are billing clients per hour, you can quickly see how such a simple service is going to save you more than enough time to make that money back again. On top of all of that, I believe it gives your business a much more professional look when using their nicely formatted templates, compared to the clunky ones we know we’ve all knocked up in the past from word processors. Whether you choose to use FreshBooks, or one of the other alternatives, I think you’re doing your business an injustice by not relieving yourself of some of the accounting burden that we all struggle with at some point. Free yourself and get back to creating! They even have a 30 day free trial where you don't need to give them any credit card details at all.

Filmtools

Filmmakers go-to destination for pre-production, production & post production equipment!

Shop Now