Over the last couple of months, a number of people reached out to me with questions about buying a new camera. Some were DSLR shooters, some mirrorless enthusiasts, people looking at Cine-style cameras from Arri, Sony and Red. Yet in every conversation, there was a single refrain from all of them.

Where have all the cameras gone?

When I started reaching out to people in general manufacturing, everyone told the same story, lamenting that there is nothing that anyone can do, except pay more or wait until the market catches up. However, when not one single person would allow me to mention their name or quote a company affiliation, I knew there was a story. It was clear from the indications I was getting that there were some issues on the manufacturing side.

While online retailers like B&H and Adorama appear to have inventory for their most popular items, the larger group of independent retail camera dealers are not so lucky, scrambling behind the scenes to find cameras and accessories for their customers. When asked to look into it, little did I know I would delve into corporate intrigue, worldwide shipping issue, cutthroat manufacturers and Covid.

A very large part of the supply issue is undoubtedly a residual effect from Covid. Pandemic restrictions tightened every manner of supply chain around the globe. The pandemic started with hoarding toilet paper and disinfecting wipes. Now, 18 months later, most of the world’s commodities and supply chains have been ravaged too. Like most electronics, chips, cameras, and lenses cannot be created on a Zoom call or be assembled in a home office. Adding that most of the world’s population outside the United States are less than 10% vaccinated, many of the people I talked to are convinced the supply chain for some cameras and a number of accessories to remain constrained for another 12-24 months.

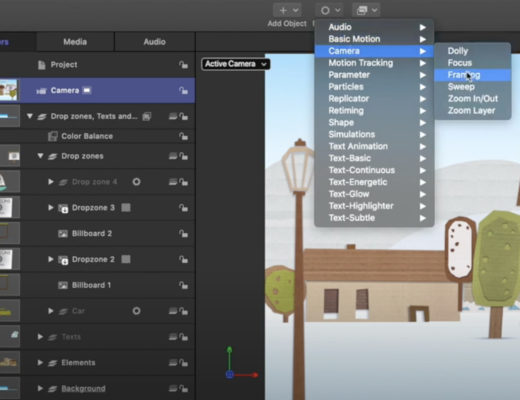

Everyone thinks about the CPU and GPU chips in their computers, but few think of the thousands of other chips at play in all of our devices, from the USB and Thunderbolt controllers to the chipsets that handle connectivity via Bluetooth, Wifi, Ethernet, or cellular communications all need to be delivered, assembled and tested before that product makes it to market. Supply chains rely on “just in time” or scheduled manufacturing. In that model, sub-assemblies and selected components arrive at the factory just prior to being assembled into the final products. When critical components do not arrive in a timely manner that delay effectively shuts down that product’s assembly line.

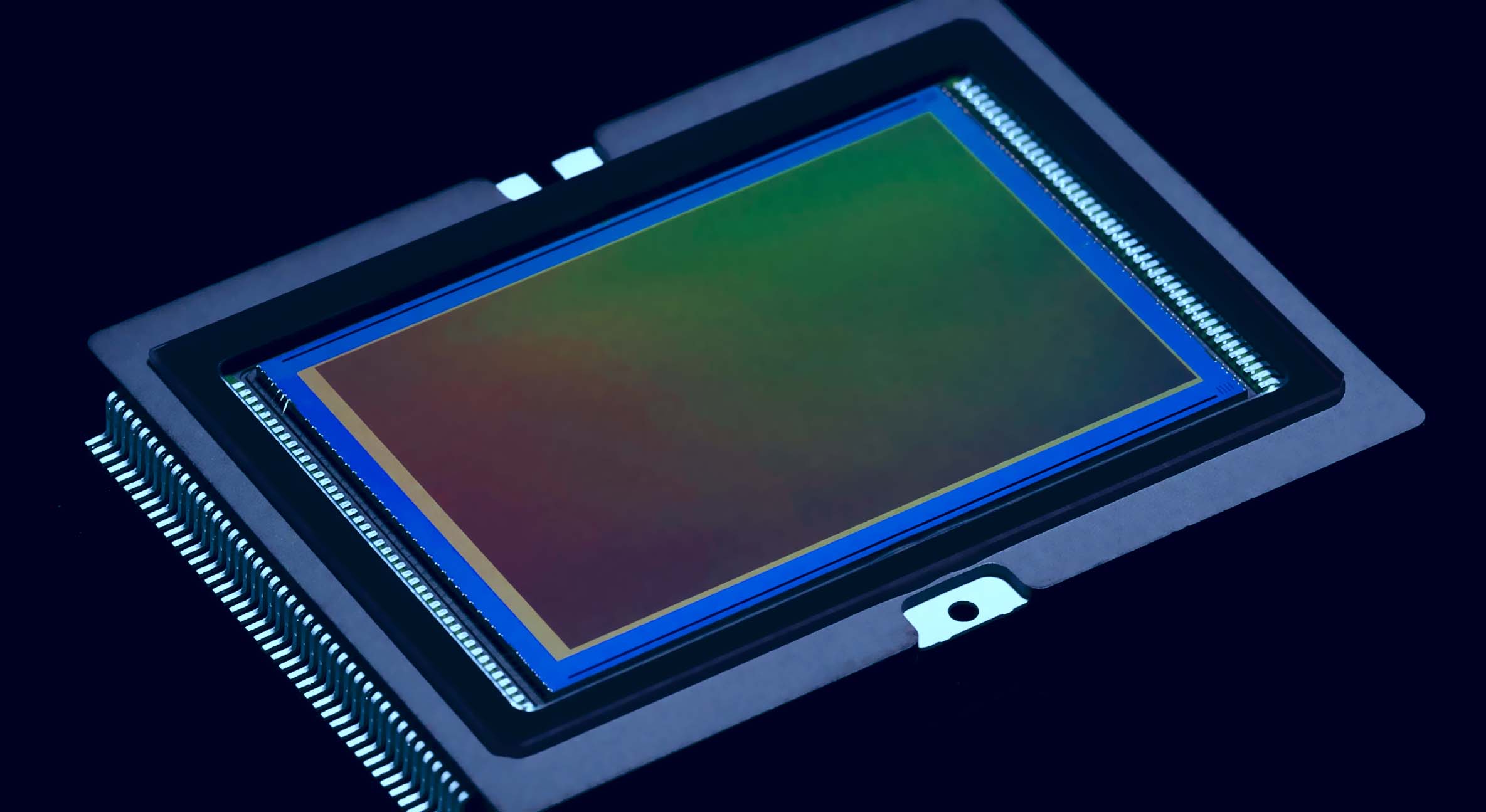

While the manufacturing delays do not affect all devices, it is a single subset of chips that are being affected most. Called a “Field Programmable Gate Array” or FPGA, is the data processing monster at the center of our world. Cars use them for smart functions like lane assist or collision avoidance, integrating your phone, or control of your car’s self-driving or parking functionality. In cameras, FPGAs control the data throughput, from frame rates and color science to the flavor of Raw, ProRes, or H.264 compression used. It is that reprogrammability that allows your I/O, graphics cards, and camera’s functions to be modified by the OS or upgraded via “firmware” to change the embedded command code that controls the functionality in each chip.

It is that programmability causing the issue. In the automotive marketplace, vehicles have more parts and procedural avenues to absorb or manufacturers redirect the increased chip costs within their pricing structure. Why sell chips to a camera company when some of the auto manufacturers are willing to pay 2x-3x the commodity pricing for FPGAs? When there are 150 or more programable chips in every new car or truck on the market, those couple of chips in your camera just don’t have the same fiscal weight in the marketplace as the auto manufacturers, reaffirming the old adage “money talks”.

What does all this mean for us in media and entertainment?

The limited worldwide market for professional cameras systems and their accessories will limit increases on the price camera manufacturers are willing to pay for chips. Restricted by the low profit on most professional and consumer products, that need to be profitable as compared to the open markets in gaming or crypto-mining where the wildly fluctuating cost of goods is just absorbed.

I predict that higher-end camera systems will stay in restrained supply for the next 6-12 months, and it will take a bit longer for new any major new camera designs to appear on the market. I stay with the impression many of the higher performance accessories required in video monitoring, remote camera control and wireless transmission will stay in limited availability for an extended period of time.

It means you may have to wait a little longer for products to arrive. There will be a short-term reduction in product development as manufacturers wait for chip pricing to stabilize. These shortages may also drive an increase in more diverse manufacturing capabilities and facilities worldwide as the cost of goods levels out as manufacturing stability returns to the marketplace.

Much like the limited supply of toilet paper at the beginning of the pandemic, once people stop panicking, the market will stabilize, the available supply levels will increase and products will rebound.

Filmtools

Filmmakers go-to destination for pre-production, production & post production equipment!

Shop Now